Mergers and acquisitions involve the potential for the relevant competition authorities to scrutinise a deal and, if they think it may harm competition, impose remedies or prohibit it altogether.

Mergers and acquisitions involve the potential for the relevant competition authorities to scrutinise a deal and, if they think it may harm competition, impose remedies or prohibit it altogether.

This article focuses on merger control in the UK, by the Competition and Markets Authority (CMA).

The better the assessment of these intervention risks (sometimes known as ‘merger control risks’) the better the judgments companies are able to make on matters such as:

- whether to go ahead with a putative transaction or to re-shape it to mitigate the potential competition risks

- whether or not to notify deals to the CMA

- (it’s worth noting here that non-notified deals called in for examination by the CMA were at record numbers in 2018)

- what they need to do to manage and mitigate risks, both before and during an investigation – recognising the potential for unwelcome surprises, including:

- unexpected merger remedies or

- costly Phase 2 investigations that the company hadn’t anticipated

- whether or not to offer remedies to head off problems at Phase 1 or risk reference to a full Phase 2 investigation.

In practice companies adopt a wide spectrum of approaches, ranging from no risk analysis at all right up to a full replication of the assessment that the CMA might take.

Most lie somewhere in between but many make limited use of lessons from past cases.

As a result companies are regularly surprised by Phase 1 outcomes.

With just over 300 Phase 1 merger decisions now published there are many insights available that companies can use, and in some cases are using, better to assess and manage their prospects.

Here are four initial steps companies can take to help utilise learning from those decisions much more effectively:

1.Take into account the full range of risk factors identified in past cases, not just some of them.

Ignoring even one of the main risk factors gives an unrealistic outlook which detracts from effective planning.

Risks unrecognised cannot be mitigated or managed.

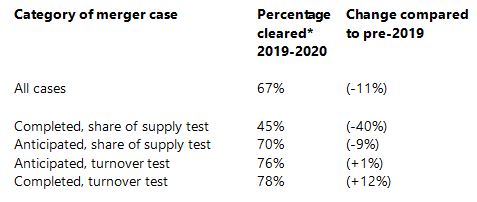

Looking across past cases, where three of the top risk factors are present the Phase 1 clearance rate has been less than 20%. (And in 2018 it was 0%).

This is orders of magnitude lower than the average clearance rate (of 67%).

What’s more, the problematic deals in this ‘higher risk’ category have been disproportionately more likely to be referred to Phase 2 investigation, rather than being remedied at Phase 1.

2. Recognise the risk in ‘low risk’ mergers

The key here is that:

Low risk is seldom no risk.

This is where CEOs have most often been taken by surprise because

- There is a tendency to underestimate risks in ‘lower risk’ cases (especially from factors that are largely or wholly outside the merging parties’ control) and

- Mergers in the ‘lower risk’ category account for a large number of cases.

Even in the 73 cases to date where none of the top competition risk factors materialised the CMA found problems in 15 of these ‘lower risk’ cases, of which 6 went on to a full Phase 2 investigation.

15 cases since the CMA began equates to 2 or 3 cases each year. That’s a lot of scope for surprise.

3. Understand the impact of different types of risk .

There are now enough previous CMA decisions to be able to gauge the influence of different factors on case outcomes and to take this into account in focusing effort on the aspects that really matter to building a stronger case.

For instance:

- What if a transaction involves more than one type of competition issue?

- What if customers and/or competitors complain?

- What if a case involves many local markets?

- What if there are unhelpful internal business documents?

- What if these factors combine?

In an earlier blog, I looked specifically at the role that so-called ‘market shares’ have played in merger decisions.

And in this one, I showed how merging companies paid too little attention to how closely they compete with one another.

4. Learn from cases that have a similar risk profile

In preparing for a CMA merger investigation most companies take a look at what happened in previous cases in their own sector.

There’s nothing wrong with that but it does mean that a lot of relevant case-learning often goes untapped.

It can be especially insightful to look at what made the difference between clearance and non-clearance in cases with a similar risk profile to your own, including those outside one’s own sector.

In conclusion…

Understanding and managing merger control risks can help avoid costly mistakes and focus case-making effort.

The CMA’s 300 merger decisions to date provide plenty of insights that can be deployed in a very practical way in order better to manage risk and build a stronger competition case.

——————————————————————————————————————-

This article has focused on risk management and is based on analysis from my comprehensive database of CMA merger decisions.

In addition the 300 cases to date offer many other lessons as to how best to make a merger case. These feature prominently in my merger briefings.