In June the CMA published its 500th merger decision.

There’s little doubt that the profile of UK merger decisions has developed a lot since the CMA began. No surprise there, as a great deal can happen over 9 years.

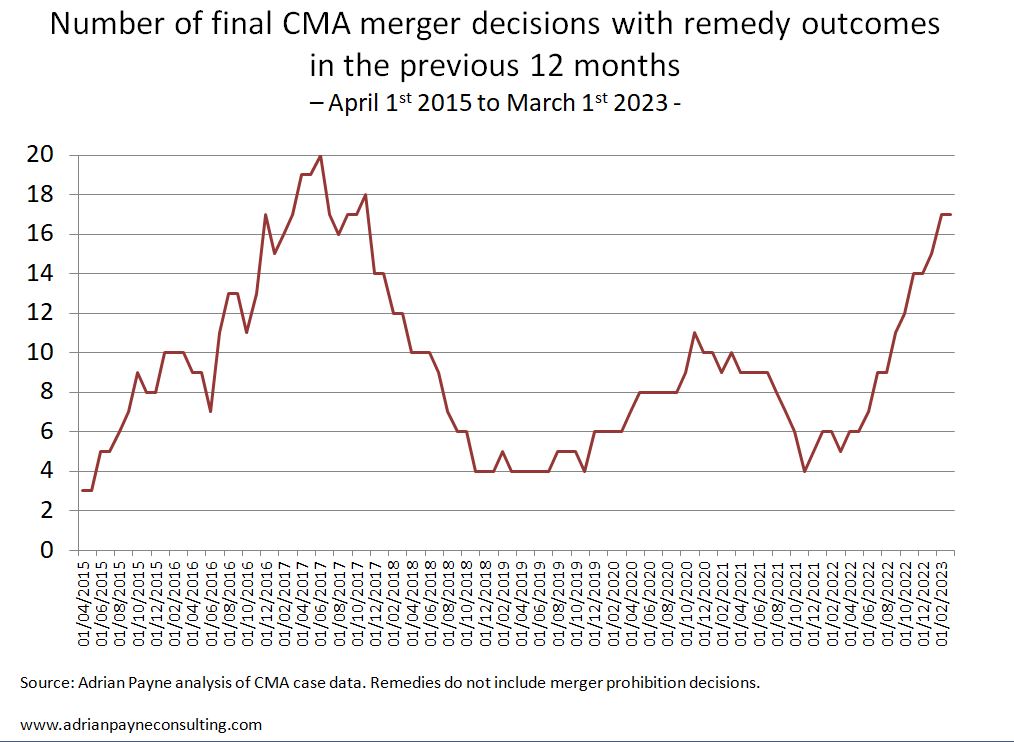

It seems that many readers (especially advisers) are sympathetic to the first of the somewhat tongue-in-cheek narratives I set out in my previous blog, although with a more measured overarching headline, along the lines that the CMA has become much stricter on mergers.

But what lies below that sort of headline?

What exactly does it mean? And for whom?

And what call to action should it have for merging parties, investors and others?

The reason these questions are important is revealed when one looks below the aggregated statistics that the CMA publishes by using data published in case decisions.

In future blogs I plan to say more on all of this, based on recent research I have been doing looking at the CMA’s first 500 merger cases – ‘The CMA At 500’.

Comparing the first 250 and the second 250 brings out many unexpected similarities and differences.

The ‘stricter enforcement’ narrative, it turns out, is much more nuanced that it might first appear from the headline numbers and applies unevenly across different types of case.

Many companies relying on the simple headline ‘stricter trend’ in thinking about merger control risk will be well wide of the mark. The average is different from the typical.

If interested, do watch out for my blogs on ‘The CMA At 500’ or contact me to find out more about my presentation on the research.