Subscribe to continue reading

Subscribe to get access to the rest of this post and other subscriber-only content.

Subscribe to get access to the rest of this post and other subscriber-only content.

Subscribe to get access to the rest of this post and other subscriber-only content.

Subscribe to get access to the rest of this post and other subscriber-only content.

As the year draws to a close I’d like to wish all my website visitors a wonderful Christmas.

And to say special thanks to all those of you who subscribe to my posts for your active interest and engagement during 2024, especially in my regular Open House discussions.

All best wishes for 2025.

Adrian

————————-

If you are a subscriber and missed them – here are the 3 most viewed posts during 2024:

A Prime Source Of Groupthink In CMA Merger Cases

Here’s a selection of some of recent articles and speeches relevant to UK merger control……………..

1. Mark-ups

Here Ian Small examines what mark-ups tell us about competition and merger control in Europe.

2. Cerelia/Jus-Rol

Christopher Hutton and colleagues take a look at the Cerelia/Jus-Rol decision – link here.

For more on why this case wasn’t as unusual as it might seem, see this post from my blog.

3. Tougher Merger Control Ahead?

In this article Ninette Dodoo and colleagues envisage tougher merger control worldwide. Which points apply to the UK?

4. Too Interventionist?

CMA Chief Executive Sarah Cardell rebuts criticisms of the CMA’s approach to merger control in this speech. I’ll be looking at some of the points she discusses in forthcoming blog posts

5. The Power Of Competition

In this speech, new CMA Chairman, Marcus Bokkerink, draws on his 30 years’ business experience to reflect on what competition means and the role of the CMA.

Click here if you would like to see my previous selection of articles

Last week the CMA announced that it has provisionally found so-called ‘vertical’ competition problems with the Microsoft/Activision deal, centring on the popular game ‘Call of Duty’.

A vertical problem is one that results from of the coming together – or greater coming together – of different levels in a supply chain, rather than a combination at the same level.

In the past few days there has been a lot of commentary on last week’s announcement, some of it suggesting that this case is somehow unique or unusual.

So – How unusual is this outcome?

As always, it depends how you measure it. But here are a couple of thoughts………

1……………..

This case is one of 14 where the Phase 1 investigation identified vertical competition problems sufficient to justify reference to an in-depth Phase 2 investigation.

To put this is context, there have been around 90 completed CMA Phase 2 investigations to date.

Five of the previous thirteen survived the CMA process.

This is a very similar survival rate to other Phase 2 cases

2………….

In my assessment, the Microsoft/Activision CMA Phase 2 investigation is one of eight to focus primarily or exclusively on vertical matters.

If the CMA decided to prohibit the current transaction it would mean that three of the eight did not survive the CMA process.

If, instead, the CMA accepted a remedy to the competition problems identified, this would the first among these eight cases.

————————–

There may well be other ways of looking at the question of how distinctive this case is.

Do comment below or drop me a line if you have other perspectives.

This post builds on data from a briefing on this case held in the first week of the year which also looked at the detail of the Phase 2 process and the significance of the extension to the Phase 2 timetable.

There’s been a lot of attention recently on a flurry of merger transactions that have been abandoned at Phase 2 of the Competition and Market Authority (CMA) merger control process.

Some say that this is because the CMA has got tougher on mergers, especially under the leadership of Andrew Tyrie.

Overall,  however, the proportion of investigated transactions that do not proceed – either because they are abandoned by the parties or prohibited by the CMA – has been almost identical under the CMA to the proportion under its predecessor body, the Competition Commission (CC).

however, the proportion of investigated transactions that do not proceed – either because they are abandoned by the parties or prohibited by the CMA – has been almost identical under the CMA to the proportion under its predecessor body, the Competition Commission (CC).

However, the CMA allows certain deals to proceed without formal investigation that would once have been reviewed under its predecessor agencies.

If the figures were adjusted to allow like-for-like comparison it is arguable that a lower proportion of deals are abandoned or prohibited following CMA scrutiny than was previously the case.

Nevertheless, it is also the case that the percentage of investigated deals abandoned or prohibited has been at record high levels over the past couple of years, contrasting with very low levels in the CMA’s first four years.

The key question is the extent to which recent figures represent normal annual variation, a sign of tougher CMA policy or a sign that companies have attempted riskier transactions.

My own analysis suggests that the profile of cases has played an important part.

In particular, compared to previous years, there have been notable increases in the percentage of cases involving:

In 2019, for example, nearly 10% of cases involved all three features – much higher than previously.

At the same time a sharp fall in the proportion of cases involving assets with potential for divestment to solve competition problems fed directly through to:

Looking ahead, a big question is whether the fall out from the Covid-19 crisis will further embolden firms to undertake deals with significant levels of merger control risk.

————————————————————————————–

What proportion of deals investigated by the CMA has been prohibited or abandoned?Click below on the figure you think is closest to the answer:

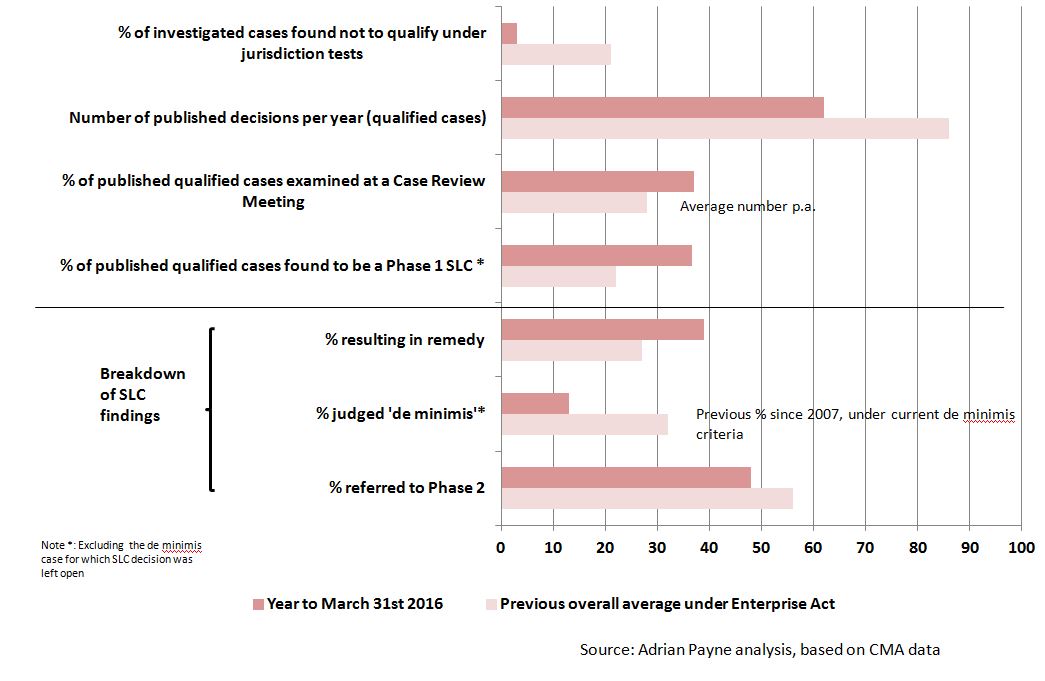

This post looks at the pattern of merger control decisions during the Competition and Markets Authority’s (CMA’s) second full year, which ended on March 31st. The decisions covered are those for which final decisions were published during the year.

In summary:

The 62 published CMA Phase 1 decisions was the lowest number of any year since the Enterprise Act came into force and well down on 2015/16.

A third successive sharp drop in the number of non-notified mergers that the CMA ‘called in’ for investigation contributed to the fall. Only 10 cases were called in, the lowest number I can recall for any year. Another record.

Phase 1 Merger Decisions – 2015/16 compared to previous years

2. A record low number of decisions was found not to meet the jurisdiction criteria

The number and proportion of published cases found not to meet the qualifying tests for jurisdiction was in 2015/16 a fraction of its historic average – and by far the lowest in any year so far under the Enterprise Act.

3. Phase 1 competition problems at a record high

The proportion of Phase 1 cases meeting the jurisdiction tests (so-called ‘qualified cases’) that was found to threaten a ‘substantial lessening of competition’ (SLC) doubled compared to the CMA’s first year and reached a record high of 38%.

There are two elements to this that are worth noting:

The proportion of qualified cases decided at Phase 1 was the lowest to date under the Enterprise Act.

This result stems from the fact that, even though the proportion of problematic cases referred to Phase 2 for further investigation was well below average, the percentage of problematic cases in the overall caseload was at a record high, as described above.

This statistic relates to so-called ‘de minimis’ cases. It is a great example of how one needs to look at individual cases (both notified and un-notified) in order to interpret the result.

Might it indicate that the CMA is taking a harder line on arguments put to it that a case is too small to warrant further investigation? Or does it show that the CMA is calling in fewer potential ‘de minimis’ cases? Cases strongly favour the latter.

6. A record high for Phase 1 remedies

The proportion of problematic cases dealt with by remedies at Phase 1 rose to a record high of nearly 40% in 2015/16.

It is striking that, at one point during the year, seven out of ten consecutive SLC decisions (excluding de minimis cases and automatic references) were dealt with through Phase 1 remedy rather than reference to Phase 2, another record under the Enterprise Act as far as I recall.

It is interesting that this is in the context of there being….

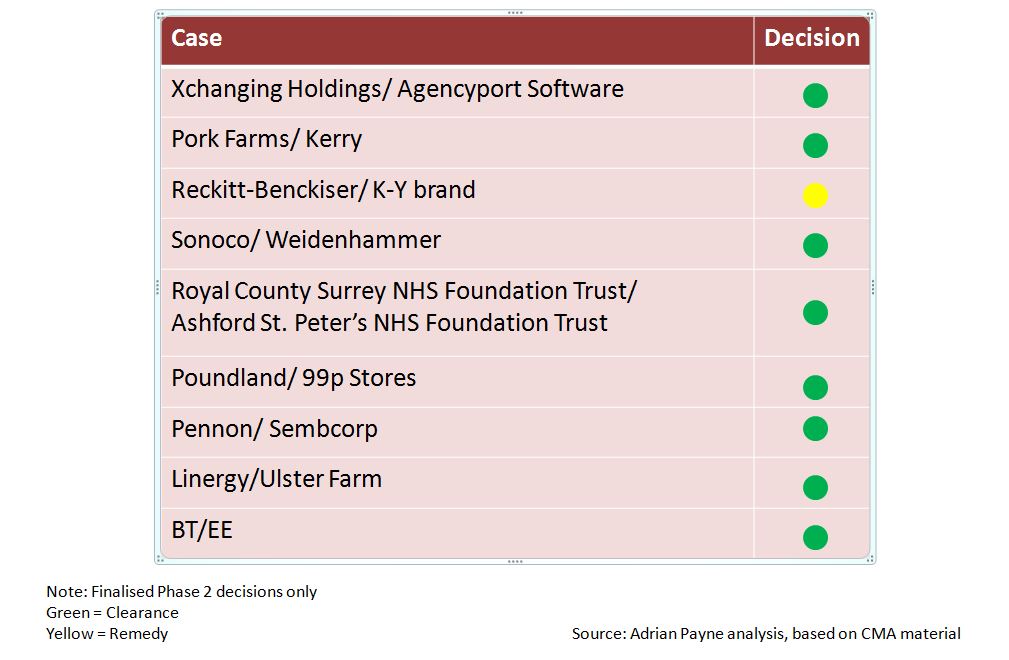

7. No Phase 2 prohibitions for the second consecutive year.

This means that the CMA Phase 2 decision-makers have yet to prohibit a merger.

There have, however, been two previous occasions in which there have been no prohibited mergers for two consecutive years. So this one isn’t a record !

2015/16 – CMA Final Phase 2 Merger Decisions

Looking ahead

Where does this cascade of new merger records leave the CMA, merging firms, competitors and customers?

There is little doubt that the CMA has become increasingly selective in the cases it has chosen to call in for investigation, to a degree that requires highly reliable information being available from merging parties in order to enable the CMA to avoid missing too many problematic deals of reasonable size.

The particular challenge here for the CMA is to make these ‘call in’ decisions accurately and quickly outside of the formal review process, without the range and quality of cross-checks that comes from interaction with competitors and customers when a case is called in for review.

As some have already recognised, for merging parties greater CMA selectivity is clearly relevant to decisions regarding notification. A key question, therefore, is whether the CMA will decide to be as selective in the year ahead. It is worth remembering here that there has already been more than one occasion under the Enterprise Act when tighter case selection has been followed by a move back to a more expansive approach to calling in cases for review.

For customers and competitors greater CMA case selectivity clearly puts a premium on making representations more quickly, rather than waiting for a formal investigation to begin. The much-expanded role for pre-notification also points in this direction, as does the earlier involvement of the Phase 1 decision-maker than used to be the case.

Turning to substantive decisions made during 2015/16 , as the National Audit Office recently put it, “the CMA is expanding the practice of clearing cases with remedies in phase 1 without the need to go for a more detailed and resource-intensive phase 2 review.”

It would be easy, however, to overstate the extent to which the 2015/16 remedies record is due to the CMA’s expanded Phase 1 remedy ambitions. In particular, the increasing level of challenge in many deal valuations (a factor in the low number of deals) seems to me to have had a notable effect on the appetite for regulatory risk and therefore the pattern of deals being brought to fruition (including their suitability for Phase 1 remedies).

Two other questions are also relevant here:

On the whole, my own 2015/16 casework leads me strongly to suspect that the CMA’s record-breaking year for mergers hides patterns that are more complicated than they first appear from the aggregate statistics.

As always, many of the main lessons for interested parties to future mergers come from understanding what has worked well or badly in individual cases during 2015/16, as well as from understanding what the aggregate figures do and do not show.

In both respects 2015/16 should leave plenty of pause for thought for all concerned.

——————————————————-

© Adrian Payne, 2016

The Competition and Markets Authority completed its first six months of cases at the end of September.

Since mid-August it has been in the unusual position (as compared with its predecessor, the Competition Commission) of having no Phase 2 merger cases to consider.

As one FD put it to me last week: “What’s up at the CMA? – I thought there has been a merger boom going on”

Well, actually, in the UK there hasn’t !…………. (as the latest official statistics show).

There are in fact several different elements to the answer, as the following picture shows.

Figure 1: UK Mergers: April 1st to September 30th 2014

On the face of it some of these figures appear very striking.

No wonder some competition practitioners are already talking of a significant change of approach by the CMA, compared to its predecessor agencies.

Indeed change would not be at all surprising because:

But, not so fast….

….whatever changes do eventually emerge, there is a real danger of drawing premature conclusions.

Six months of case data is far too short a period from which to infer changes in underlying trends. And bear in mind that the number of cases involved at the lower end of the funnel is small.

Looking at the individual cases involved and comparing them with previous years, it is just as likely that the six month figures reflect the mix of cases in terms of sector, size and the pattern of competition issues raised.

With this in mind it is worth remembering that many of the parameters in the ‘funnel’ shown above can and do vary widely from year to year.

To take just one example: the following chart shows how the proportion of qualified cases (i.e. those that have met the jurisdictional criteria) found to raise competition problems at Phase 1 has varied since the Enterprise Act came into force. The latest year’s figure is in fact not much lower than for six of the previous ten years.

Figure 2: Phase 1 ‘Substantial Lessening of Competition’ findings as a proportion of qualified merger cases

I’ll be returning to this subject in a future article so do drop me a line if you have thoughts.

In the meantime, with eleven Phase 1 decisions due for announcement over the next six weeks, the picture could change rapidly.

Then again…..

——————————————————————————————————————–

Click here for the latest UK merger control statistics.

My article on the one CMA merger reference so far is here.

My ‘A-Z of 2014 UK Merger Analysis’ presentations are taking place in January. Please get in touch if you are interested in arranging one for your firm.

UK merger control over the past year – and looking ahead

On April 1st the Competition and Markets Authority (CMA) took over UK merger control responsibilities from the Office of Fair Trading and Competition Commission.

In this article I

Phase 1

The following chart compares the year to the end of March 2014 with the average across all cases in previous years under the Enterprise Act.

The figures focus on those cases that the OFT decided to qualify for assessment under the jurisdictional tests – hence the term ‘qualified cases’.

The key points are as follows:

The signs are that the low case numbers have continued (though activity seems now to be increasing):

…. 50% down on the same point last year.

This should come as no surprise. Merger decisions occur with a time-lag and….

… the lowest number since quarterly figures were first collected in 1987.

As in previous years, the number of competitors and low increment to share of supply have been the most important factors in clearance decisions. Buyer power and entry arguments were important, however, in a small number of cases.

Phase 2

Of the references to Phase 2 made in the year up to 31st March to date there have been

Assessment methods – some points of interest

Before looking at some of the lessons for future merging parties I note here a few of the points of interest across the year in terms of the analytical approaches and techniques used by the merger authorities. These include:

More generally, there has been relatively little use of price pressure analyses this year and merger simulation has been rarely used.

By contrast, many cases have involved the use of ‘catchment area’ analysis and analysis of internal documents has been important to a number of decisions.

It is worth noting that the new (much-enlarged) CMA notification form for Phase 1 has expanded the set of internal documents that are requested upfront.

Lessons for future merging parties

Within the scope of this article it is only possible to give a brief overview but below I set out some of the lessons for future merging parties drawn from published material on Phase 1 and Phase 2 cases over the past year.

Many of the lessons have implications for pre-merger planning, both in terms of:

Here are some of the most notable points arising from the 2013/14 cases:

– Large discrepancies between the parties’ figures and those obtained by the authorities in their enquiries of customers and competitors can undermine confidence in other material the parties put forward

– This is important in pre-merger planning, in assessing the risks of a merger being referred to Phase 2 and the risk of it being found to be problematic at Phase 2.

– Bid data can be time-consuming to assemble so that it is sufficiently comprehensive. Early planning and gathering of material is therefore important.

– It is particularly important to distinguish between ‘theoretical capacity’ (which may be very large but may be costly to deploy in full) and that capacity that it may be realistic and economic to bring on stream.

– In some markets the key constraint on prices is the bidder who comes second. The key question is therefore what the merger does – if anything – to that player’s bid.

– This will become even more important looking ahead given the new merger timetables.

– For example, how close might be the price of branded goods that are heavily promoted to the price of private label products that are not?

– This helped dampen concerns about the potential for the parties to compete in one case this year.

– For example, one notable case was cleared this year despite most customers complaining about it. Equally, many cases have been referred to Phase 2 in previous years without there being significant levels of complaint.

– as shown in a ‘3 to 2’ merger where plant location and logistics opened up new opportunities for the merged firm to reduce its costs – opportunities that would not otherwise have been possible.

– as happened in one completed merger case this year – in which the increases were judged to be investments in quality

– especially in exercising the discretion not to refer cases to Phase 2 in sectors in which similar deals are possible (perhaps even likely) in other local areas.

Looking ahead

Although much will stay the same, the arrival of the CMA brings a number of changes to UK merger control the effects of which will not be clear for some time.

The main changes being made include:

For the area that I am most often involved in – merger evidence-gathering and analysis – there are many questions that the next year will start to answer, including the following:

And that is to say nothing of the more process-based questions on matters such as ‘stopping the clock’ and remedies where the devil really will be in the detail.

It may take a considerable time for the implications of the changes to become clear, particularly any unintended consequences.

Case circumstances vary considerably so that making judgements on what the changes may mean over, say, the first 10 cases – or even the first 20 – could prove as unreliable as making judgements on SLC trends from a similarly short run of cases (a topic I hope to return to in a future article).

Much more on all this in future merger workshops….

© Adrian Payne 2014