Subscribe to continue reading

Subscribe to get access to the rest of this post and other subscriber-only content.

Subscribe to get access to the rest of this post and other subscriber-only content.

Subscribe to get access to the rest of this post and other subscriber-only content.

Subscribe to get access to the rest of this post and other subscriber-only content.

Subscribe to get access to the rest of this post and other subscriber-only content.

Subscribe to get access to the rest of this post and other subscriber-only content.

Subscribe to get access to the rest of this post and other subscriber-only content.

As discussed in an earlier post, there is a widespread view that the CMA has taken a much harsher view of mergers over the past few years.

There are many different ways of trying to measure this.

Here’s one based on my ‘CMA At 500’ analysis……

The CMA has just published it 500th merger decision. What is the picture if one compares the first 250 with the second 250?

Three striking aspects to consider

1. Number of mergers not cleared unconditionally at Phase 1 –

2. Number of mergers referred for an in-depth (Phase 2) investigation –

3. Number of these Phase 2 mergers not surviving Phase 2 –

These rises look dramatic in the context of 250 cases.

On further examination they show:

But what do these movements actually mean?

To assume that changes such as these are wholly down to a tougher CMA stance would be a very big assumption – and one with the potential to deter more deals than it should or encourage firms to misdirect efforts in making their case.

How much, for example, might instead reflect change in

And to what extent are the changes evenly spread, rather than concentrated in particular parts of the case portfolio or particular periods of time (e.g. the Covid years)?

And maybe the answers vary for each of the three ‘swing’ movements listed above.

Searching For Answers

The only way to approach these questions is to delve below the headline statistics published by the CMA and look at the features of the cases themselves.

In my ‘CMA At 500’ research I have used my assessment of the features of all 500 cases to examine these questions, including through the type of analysis discussed in this blog from 2019.

Click here if you’d like me to say more about this topic in future posts.

Do get in touch if you’d like to know more about my ‘CMA At 500’ project

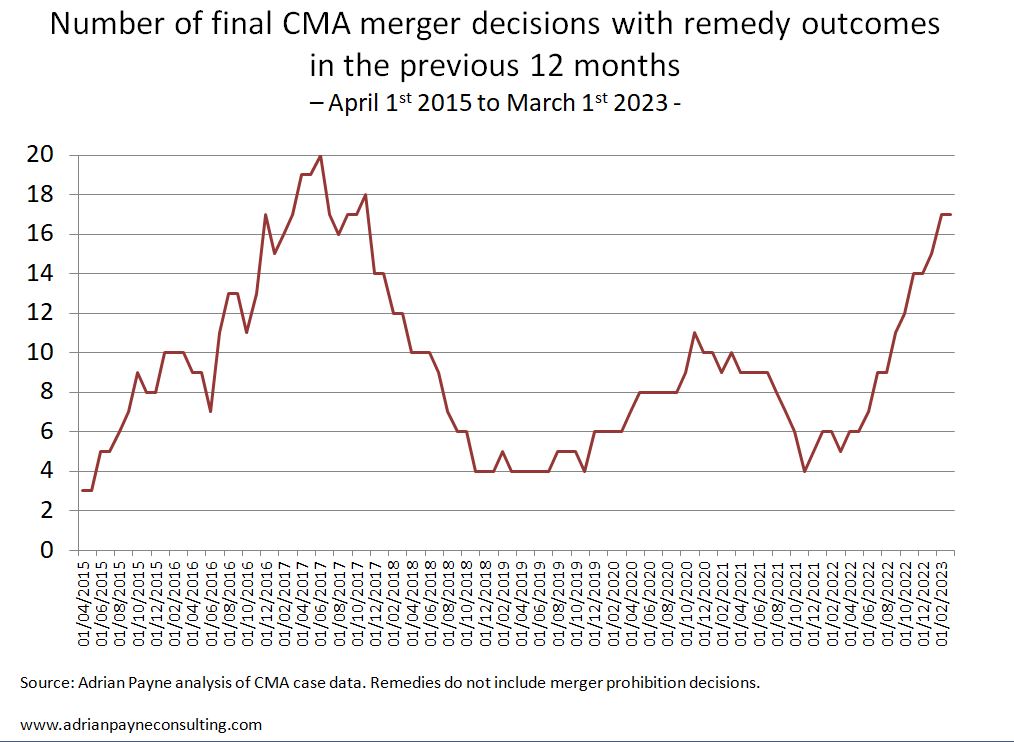

I’ve talked in recent posts (here, here and here) about the noticeable rise in CMA merger remedies, both at Phase 1 and Phase 2.

Here’s the overall picture…..

For most of the CMA’s existence the number investigations each year that conclude with competition problems being dealt with by remedies has been between four and ten.

Since last summer, however, there’s been a noticeable increase beyond the normal range – especially noticeable given that the number of public merger investigations has fallen to record low levels.

The rise in remedies seems strong but the chart helps keep things in perspective.

First, the recent number of remedy outcomes, while striking, is not unprecedented.

And, second, the number of remedies has risen and fallen several times. Short-term ‘trends’ have a habit of disappearing.

Even so, an interesting question is whether we have yet to reach ‘peak remedy’ this time around, especially given the changes to the CMA’s remedy processes that I noted in a previous post.

Other interesting ‘remedy’ topics include

Which remedy topics would you, dear reader, like to know more about? Do feel free to leave a comment or to drop me a line.

I’m expecting to say more about merger remedies in future posts. Do feel free to click the ‘follow’ button at the side of the main blog page to subscribe to the blog series.

Notes on the above chart:

For each period of 12 months the graph tracks the number of final merger decisions in that period that have been remedy outcomes. Cases are taken into account in the 12 months in which the final decision for the case is published. A Phase 1 case therefore appears in the series when the full written decision is published, unless it is referred to Phase 2, in which case it appears in the series when the full Phase 2 decision is published or the case is abandoned by the merging parties.

Here’s a question that’s worth asking if you’re assessing the prospects for the outcome of a CMA merger investigation:

In recent years which minority type of merger accounted for 100% – yes, 100% – of the marked rise in CMA Phase 1 references to an in-depth Phase 2 investigation?

Was it…

Which answer would you choose? (Do drop me a line or put your answer in the comments box below)

If there’s sufficient interest I’ll look at the main candidates in future posts.

And, no, it’s not a trick question!

One of the above is the correct answer!….

…..Which in turn means revisiting the simple ‘rising CMA intervention’ narrative that often appears in commentaries.