Subscribe to continue reading

Subscribe to get access to the rest of this post and other subscriber-only content.

Subscribe to get access to the rest of this post and other subscriber-only content.

UK parliamentary hearings often illuminate the skills involved in powerful questioning and in how to respond to questions, powerful or otherwise.

And strong questioning skills incorporate strong listening skills.

You can’t have one without the other.

It’s why I regularly cite parliamentary hearings in my training work for competition agencies, because participants in the training can watch and replay the key interactions to observe the quality of the questions and the quality of the listening.

Yesterday’s interrogation of Boris Johnson by the Privileges Committee was no exception.

In fact it was an exemplar in one area in particular……..

The importance of questioners listening actively to the answer they are being given

and asking a powerful follow-up question that builds on that answer…..

…….and the results when that doesn’t happen!

If you are building skills in this area take a look at a few of the interactions and see what you would have done differently as a questioner:

I’ve been very struck over the years by how differently companies prepare for CMA hearings during merger investigations.

Hearings are an important feature in many merger investigations, providing an opportunity for the merging firms, rivals and other interested parties to make their case.

Some hearings are turning points in a case.

Some are wasted opportunities.

Much depends on how hard the organisations involved think (or don’t think) about the objectives they set themselves.

Some prepare to dial up the rhetoric.

Some prepare to move the dial.

So, for all those with CMA hearings in view here’s a key question to start with…..

What are you really preparing for ?

Last updated: February 29th 2016

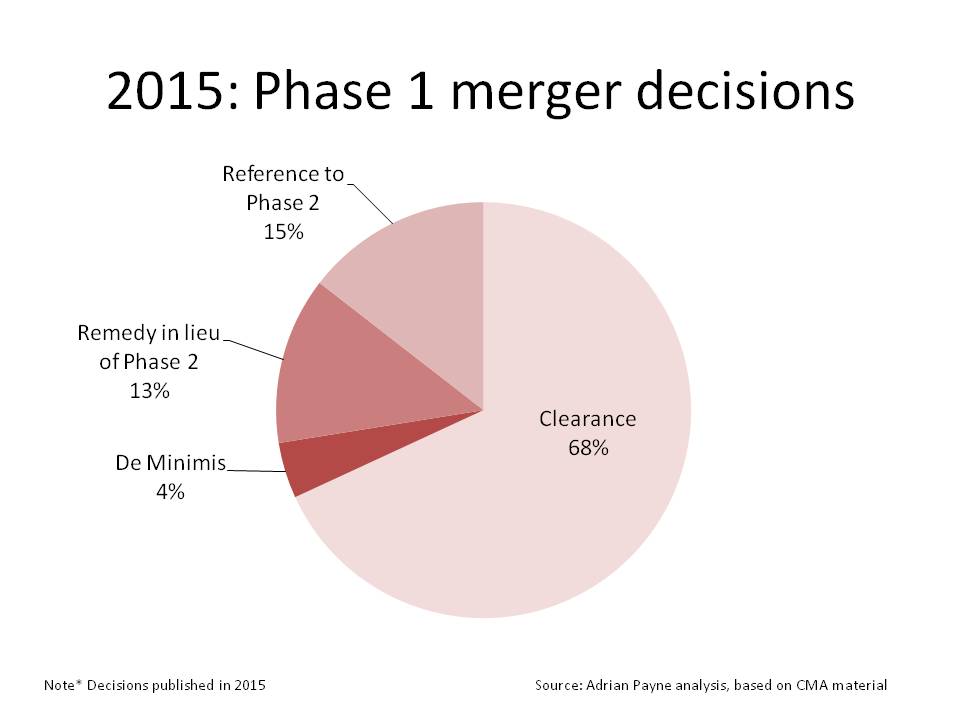

Which were the most interesting UK merger decisions of 2015, in terms of the competition analysis undertaken?

Here are my nominations, chosen from those cases that have completed their passage through CMA scrutiny (whether that was a Phase 1 assessment only or a Phase 2 inquiry as well) and for which a full final decision has been published.

To link straight to the CMA’s published decision for a case, please click on the blue highlighted titles.

Regus Group/Avanta Serviced Offices Group – Phase 1 undertakings in lieu of reference to Phase 2

The CMA found competition concerns in five areas of Central London and accepted divestments and a behavioural remedy to deal with these problems.

Points of interest included:

Muller/Dairy Crest dairy operations – Phase 1 undertakings in lieu of reference to Phase 2

The CMA found competition concerns only in the supply of fresh liquid milk to national multiple retailers in the catchment area of Dairy Crest’s Severnside dairy, especially in the South West and Wales. Undertakings in lieu of a Phase 2 investigation were offered and accepted.

Particular points of interest are:

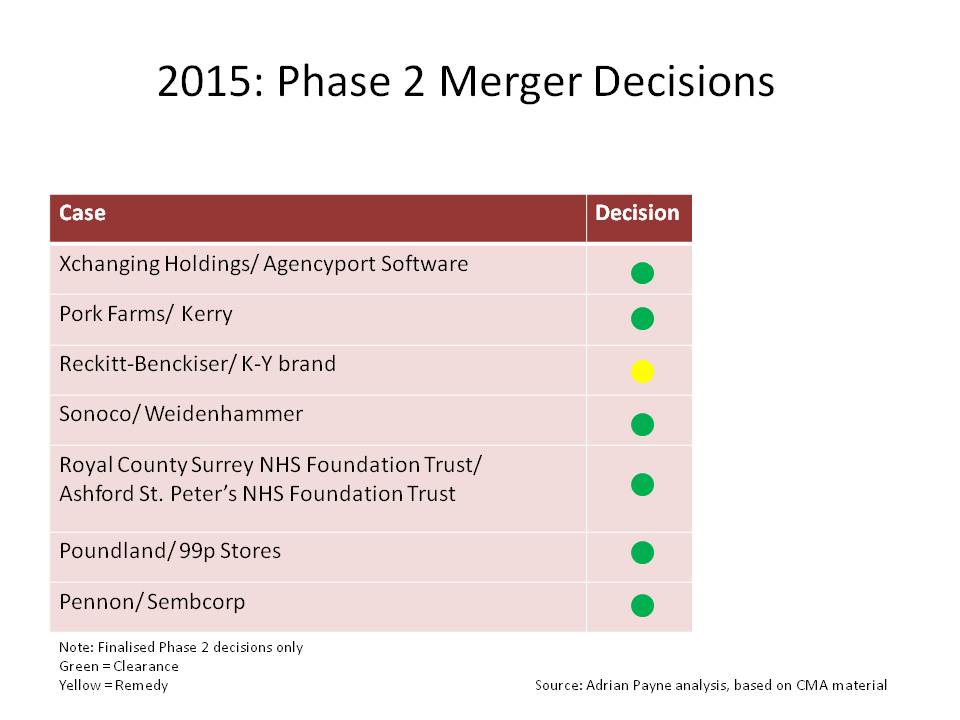

Poundland/99p Stores – Phase 2 clearance

At Phase 1 the CMA found potential concerns about the effect of the merger on competition in 92 local areas on the basis of a fairly standard retail merger assessment.

The CMA was highly critical of aspects of the parties’ online survey (as well as other aspects of their evidence such as their price-concentration and entry analysis) and therefore used cautious criteria to identify the local areas of concern in its Phase 1 assessment.

At Phase 2 the CMA commissioned its own survey covering a sample of 15 local areas. The results were used to construct a method that could be used to calculate so-called ‘Indicative Price Rises’ across all the overlap areas based on features such as the number and type of competitors and their proximity to one another.

An appendix to the Phase 2 report compares the results of the Phase 2 face-to-face survey with the Phase 1 online survey. It is a useful reminder of how much survey design can affect results.

Notwithstanding the price rise analysis, the CMA’s Phase 2 panel concluded, however, that the parties would not be likely to flex terms and conditions locally to take advantage of their stronger position in certain locations. This was based on evaluating the practicalities involved and the costs and benefits of changing certain aspects of its local offering.

The survey and profitability margin figures suggest that there could be strong incentives for the parties to close outlets in some areas where they both operate. The CMA concluded, however, that consumers would be unlikely to be harmed by any such closures because the parties have similar offerings and are located close to one another in the potential areas of concern. On this analysis customers would not therefore need to travel much further where they have to switch to the other outlet.

Despite a high level of interest in the case there were no third party submissions challenging the CMA to develop the reasoning published in its provisional Phase 2 findings. Similarly the provisional clearance decision meant that the parties themselves did not need to challenge further certain parts of the analysis. As a result the final report leaves open interesting questions that may need exploring in future retail cases.

Reckitt/K-Y brand – Phase 2 licensing remedy

The CMA found harm to competition in the supply of personal lubricants to grocery retailers and to pharmacy chains.

There are many points of interest from both the Phase 1 and Phase 2 analysis, including:

Surrey hospitals merger – Phase 2 clearance

Royal Surrey County Hospital NHS Foundation Trust (RSC) and Ashford and St Peter’s Hospitals NHS Foundation Trust (ASP) provide clinical services from their sites in Guildford, Ashford and Chertsey.

The clearance decision is significant because it is the first Phase 2 clearance of an NHS merger.

The case contains many developments of interest at Phase 2, including:

At Phase 1, Monitor accepted the case that three treatment areas would give rise to so-called ‘Relevant Customer Benefits’ (though those were not sufficient to avoid a Phase 2 reference).

Tattersalls/Brightwells – Phase 1 – No competition conclusions made. Deemed too small to merit a Phase 2 investigation

This case involved the merger of two bloodstock auctioneers. The CMA said that it could not rule out the possibility of competition concerns (set out below) but did not find it necessary to conclude on these because the concerns would be too small to justify a Phase 2 investigation

To qualify for consideration as a so-called ‘de minimis’ case the competition problems identified must be of a type that cannot in principle be remedied (otherwise the possibility of reference to Phase 2 would not arise anyway). As the CMA noted in this instance:

“The CMA’s concerns regarding the supply of bloodstock auctioneering services for low-value flat racing horses in training in the UK and Ireland may in principle have been addressed by the divestment of the Ascot lease. However, the CMA found that the competition concerns that the Merger raises in terms of elimination of Brightwells as a potential competitor in the supply of auctioneering services for store horses do not led (sic) themselves, in principle, to being addressed through UiLs in the specific circumstances of this case”.

Clearly the range of such problems left open can differ from the range of problems judged to raise competition concerns if the analysis is completed and conclusions are drawn – for example where the former include competition problems that cannot in principle be remedied and the latter include only problems that can.

Could leaving open the competition conclusions in a case therefore itself affect whether a case qualifies as too small to justify a Phase 2 investigation? In this case, for example, if the CMA had completed its Phase 1 assessment and decided that the only competition concerns related to the Ascot lease it would presumably have sought a divestment in lieu of a reference to Phase 2 and would not have permitted a de minimis outcome.

Other interesting aspects of this particular case include:

Sonoco/Weidenhammer – Phase 2 clearance

Sonoco and Weidenhammer both produce ‘composite cans’ for packaging both food and non-food products, with a very high UK share of supply.

Points of interest include the importance to the clearance decision of:

None of these seemed particularly promising arguments on the basis of the Phase 1 assessment.

The CMA found no significant competition concerns on most routes where East Coast services overlap with existing Stagecoach or Virgin Trains rail or coach services. They found, however, that the franchise award could mean higher fares or reduced service quality for rail passengers travelling between Peterborough, Grantham and Lincoln and for coach and rail passengers travelling between Edinburgh, Dundee and Aberdeen.

Points of interest include:

In its first review of a merger between major pub operators, the CMA has adopted a long overdue fresh approach to the way transactions in this sector are assessed.

The many points of interest include:

The big question is how soundly-based this new approach is as there is very little commentary in the published decision on the internet survey that underlies it and no significant reference to the sensitivity of results to changes in the main variables, including the ‘discount’ factor.

These factors also make it difficult to tell how cautious (or not) the assessment was for a Phase 1 decision.

The Original Bowling Company/Bowlplex – 6 divestments in lieu of reference to Phase 2

The decision packs a lot in to its 29 pages. Analytical points of note include:

——————————————————————————————–

My training seminar ‘The 17 UK Merger Cases Most Worth Knowing About’ looks at that select band of cases that have most influenced how UK mergers are assessed. Details available on request.

UK merger control over the past year – and looking ahead

On April 1st the Competition and Markets Authority (CMA) took over UK merger control responsibilities from the Office of Fair Trading and Competition Commission.

In this article I

Phase 1

The following chart compares the year to the end of March 2014 with the average across all cases in previous years under the Enterprise Act.

The figures focus on those cases that the OFT decided to qualify for assessment under the jurisdictional tests – hence the term ‘qualified cases’.

The key points are as follows:

The signs are that the low case numbers have continued (though activity seems now to be increasing):

…. 50% down on the same point last year.

This should come as no surprise. Merger decisions occur with a time-lag and….

… the lowest number since quarterly figures were first collected in 1987.

As in previous years, the number of competitors and low increment to share of supply have been the most important factors in clearance decisions. Buyer power and entry arguments were important, however, in a small number of cases.

Phase 2

Of the references to Phase 2 made in the year up to 31st March to date there have been

Assessment methods – some points of interest

Before looking at some of the lessons for future merging parties I note here a few of the points of interest across the year in terms of the analytical approaches and techniques used by the merger authorities. These include:

More generally, there has been relatively little use of price pressure analyses this year and merger simulation has been rarely used.

By contrast, many cases have involved the use of ‘catchment area’ analysis and analysis of internal documents has been important to a number of decisions.

It is worth noting that the new (much-enlarged) CMA notification form for Phase 1 has expanded the set of internal documents that are requested upfront.

Lessons for future merging parties

Within the scope of this article it is only possible to give a brief overview but below I set out some of the lessons for future merging parties drawn from published material on Phase 1 and Phase 2 cases over the past year.

Many of the lessons have implications for pre-merger planning, both in terms of:

Here are some of the most notable points arising from the 2013/14 cases:

– Large discrepancies between the parties’ figures and those obtained by the authorities in their enquiries of customers and competitors can undermine confidence in other material the parties put forward

– This is important in pre-merger planning, in assessing the risks of a merger being referred to Phase 2 and the risk of it being found to be problematic at Phase 2.

– Bid data can be time-consuming to assemble so that it is sufficiently comprehensive. Early planning and gathering of material is therefore important.

– It is particularly important to distinguish between ‘theoretical capacity’ (which may be very large but may be costly to deploy in full) and that capacity that it may be realistic and economic to bring on stream.

– In some markets the key constraint on prices is the bidder who comes second. The key question is therefore what the merger does – if anything – to that player’s bid.

– This will become even more important looking ahead given the new merger timetables.

– For example, how close might be the price of branded goods that are heavily promoted to the price of private label products that are not?

– This helped dampen concerns about the potential for the parties to compete in one case this year.

– For example, one notable case was cleared this year despite most customers complaining about it. Equally, many cases have been referred to Phase 2 in previous years without there being significant levels of complaint.

– as shown in a ‘3 to 2’ merger where plant location and logistics opened up new opportunities for the merged firm to reduce its costs – opportunities that would not otherwise have been possible.

– as happened in one completed merger case this year – in which the increases were judged to be investments in quality

– especially in exercising the discretion not to refer cases to Phase 2 in sectors in which similar deals are possible (perhaps even likely) in other local areas.

Looking ahead

Although much will stay the same, the arrival of the CMA brings a number of changes to UK merger control the effects of which will not be clear for some time.

The main changes being made include:

For the area that I am most often involved in – merger evidence-gathering and analysis – there are many questions that the next year will start to answer, including the following:

And that is to say nothing of the more process-based questions on matters such as ‘stopping the clock’ and remedies where the devil really will be in the detail.

It may take a considerable time for the implications of the changes to become clear, particularly any unintended consequences.

Case circumstances vary considerably so that making judgements on what the changes may mean over, say, the first 10 cases – or even the first 20 – could prove as unreliable as making judgements on SLC trends from a similarly short run of cases (a topic I hope to return to in a future article).

Much more on all this in future merger workshops….

© Adrian Payne 2014

It is that time of the year when newspapers and magazines are full of ‘book of the year’ recommendations.

Well, by way of contrast……

….here is my selection of ten of the most interesting new (freely-downloadable) research papers I have read in 2013.

A great antidote to an overdose of turkey and tinsel !

The selection covers both theory and practice and ranges from hospital mergers….to topical issues in merger policy…. to what makes for successful mergers.

Do drop me a line if you think there are other papers as deserving of a read as those on the list.

So, here are my ten (in no particular order)……

1. Quality matters

Most studies of the effects of past mergers focus on price. Here is that rare beast – one that looks at how two past mergers affected quality.

‘Mergers and Product Quality: Evidence from the Airline Industry, Chen and Gayle, MPRA, November 2013

Click to access MPRA_paper_51238.pdf

2. Going forward

Here is another paper looking at an often overlooked issue: how the prevalence of forward contracting in a sector affects the impact that horizontal mergers may have. Maybe one to consider when that next electricity merger comes along?

‘Forward Contracting and the Welfare Effects of Horizontal Mergers’, Miller, EAG, May 2013

3. Could hospital mergers be good for you?

Hospital and health mergers are very much in the news these days. Here’s a paper that shows how price, quality, coinsurance and regulation can interact to produce some surprising results.

‘Hospital Mergers: A Spatial Competition Approach’, Brekke, Siciliani and Straume, NHH, April 2013

4. Bad news for R&D?

This paper uses a differences-in-differences approach to look at the effect of over 200 mergers on R&D.

On the face of it, it looks like bad news for R&D. But is it actually harm to consumers?

‘M&A and R&D – Asymmetric Effects on Acquirers and Targets’, Szücs, DIW Berlin, October 2013

http://www.diw.de/documents/publikationen/73/diw_01.c.429740.de/dp1331.pdf

5. Judging books by titles

Don’t let the title put you off. This is one of the most important papers of 2013. Its results should give merging companies and competition authorities a lot of food for thought.

‘Merger Externalities in Oligopolistic Markets’, Gugler and Szücs, DIW Berlin, June 2013

6. Timing is everything

I can think of several UK cases where the fact that the deal has been investigated after completion has helped clarify aspects of the case!

This paper puts the issue into a wider policy context and highlights the main factors that should influence timing. But is it really a case of either/or?

‘Ex post or ex ante? On the optimal timing of merger control’, Cosnita-Langlais and Tropeano, Economix Working Papers, June 2013

Click to access WP_EcoX_2013-22.pdf

7. Are cartels and mergers substitutes?

The short answer is ‘yes’, according to this paper. Clues perhaps for the Merger Intelligence function in a voluntary regime?

‘Do Cartel Breakdowns Induce Mergers?’, Hüschelrath and Smuda, ZEW, June 2013

8. A new demand-side efficiency

Some interesting new arguments in this paper, of particular interest where search costs are high.

‘Search Costs, Demand-side Economies and the Incentives to Merger under Bertrand Competition’, Moraga-Gonzalez and Petrikait, February 2013

Click to access Moraga_Petrikaite_3.pdf

9. Culture clashes

Clash of cultures often gets blamed for mergers that don’t deliver. But how strong is the theory and evidence supporting this view?

This paper contains some interesting insights into one of the most important questions about M&A.

‘The Role of Corporate Culture in Mergers and Acquisitions’, Bouwman, May 2013

Click to access BouwmanCorpCultureM&A%20Dec2012.pdf

10.Mergers that matter

An interesting approach to measuring what affects propensities to merge and who benefits from merger.

Mergers that matter: The Value Impact of Economic Links’, Harford et al, July 2013

Click to access Paper%20-%20Jarrod%20Harford.pdf

Happy reading…and Merry Christmas one and all