It’s not often that the CMA comes bearing Christmas news of great promise to dozens of future merging companies. But this Christmas could be the one.

I’m talking here about the CMA’s ‘de minimis exception’ which has previously allowed the CMA to clear problematic mergers that it deems too small to merit the costs of a Phase 2 investigation (as long as clear-cut Phase 1 remedies are not available to deal with the competition problems identified).

Glad Tidings Of Joy

The CMA‘s proposal to double – to £30 million – the maximum size of market that it may exempt from further investigation or intervention (under its so-called ‘de minimis exception’) heralds glad tidings to many companies contemplating future mergers.

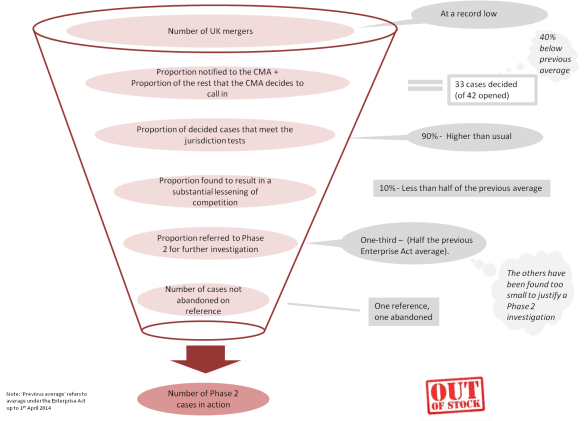

The change looks set to bring the ‘de minimis exception’ within reach of dozens of merging companies over coming years. The CMA doesn’t publically put a number on it but figures compiled for my ‘CMA At 500’ project suggest no mere Christmas bauble when compared to existing case numbers.

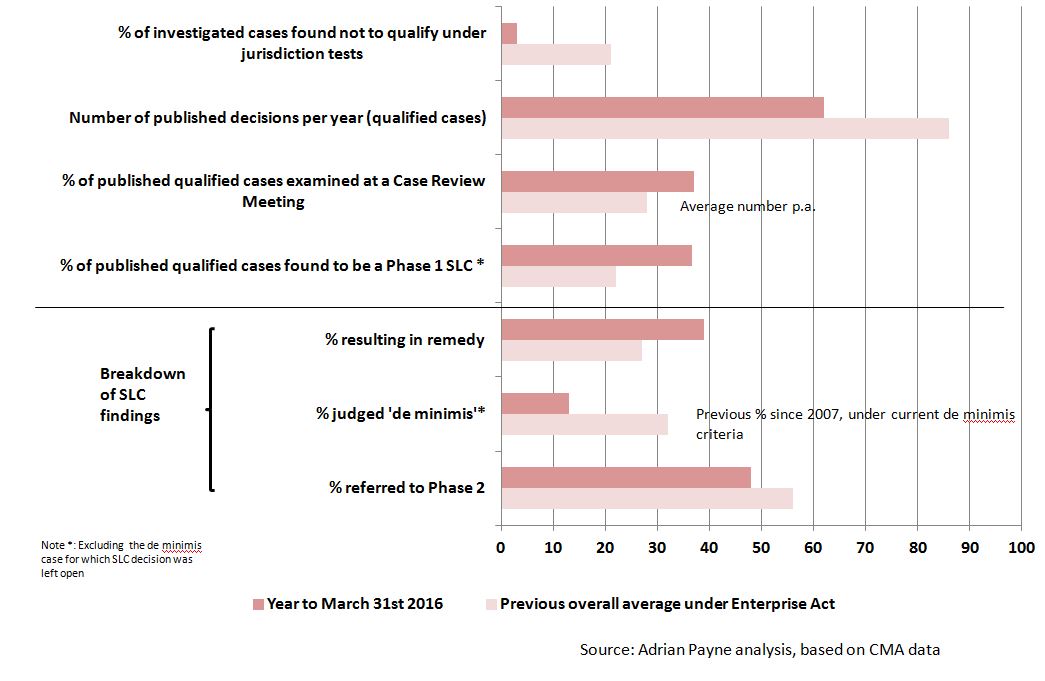

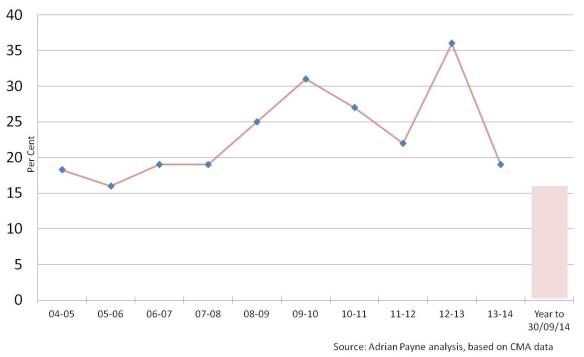

Even under the previous thresholds there have been 42 public cases to date in which parties mounted ‘de minimis’ arguments – nearly 10% of all cases to date.

In addition, the figures suggest that a large number have been screened out at briefing paper stage or gone ahead without any CMA scrutiny.

By looking at the market size profile across cases the CMA will know just how big a change the doubling of the market size threshold could make to these numbers.

And this doesn’t allow for the fact that the new proposals also bring hopeful news to many firms in small-to-medium-sized markets who have previously screened out deals because of perceived merger control risk.

For the many of you who have considered ‘de minimis’ policy as part of your risk assessment it may soon be time to have another look at the deals you’ve so far rejected or put on the back burner.

A Heavenly Song

The proposals also sweep away the long-established cost-benefit framework for assessing whether the harm from a ‘small market’ merger exceeds the CMA‘s costs of a Phase 2 in-depth investigation – a key part of previous ‘de minimis’ policy.

This change is connected to the doubling of the threshold to include medium-sized markets, as the threshold will now be at a level where potential cost to consumers of problematic mergers in markets under the threshold will routinely exceed the costs of further CMA investigation or intervention – and by orders of magnitude.

The change also means that merging companies will save time and costs through shorter investigations and more cases able to proceed without public scrutiny.

Ding Dong Merrily On HIgh

And better still…..

In future the ‘de minimis’ exception may be considered even where clear-cut Phase 1 remedies are available that would avoid the costs of a Phase 2 reference – again, consistent with dropping the cost-benefit framework.

Given the proportion of cases that result in Phase 1 remedies that looks like a another significant benefit to merging parties and another bold change to the rules on a narrow cost-benefit view.

Again, analysis of past ‘de minimis’ candidates that have resulted in Phase 1 remedies indicates the potential scale of the change.

Beware Scrooge

Before merging companies get too excited, however, there is one big uncertainty to gauge about how the new ‘de minimis’ system will operate.

In future the CMA will be able to refuse to apply the ‘de minimis exception’, where the markets involved are deemed “priority” and/or “important” for various reasons.

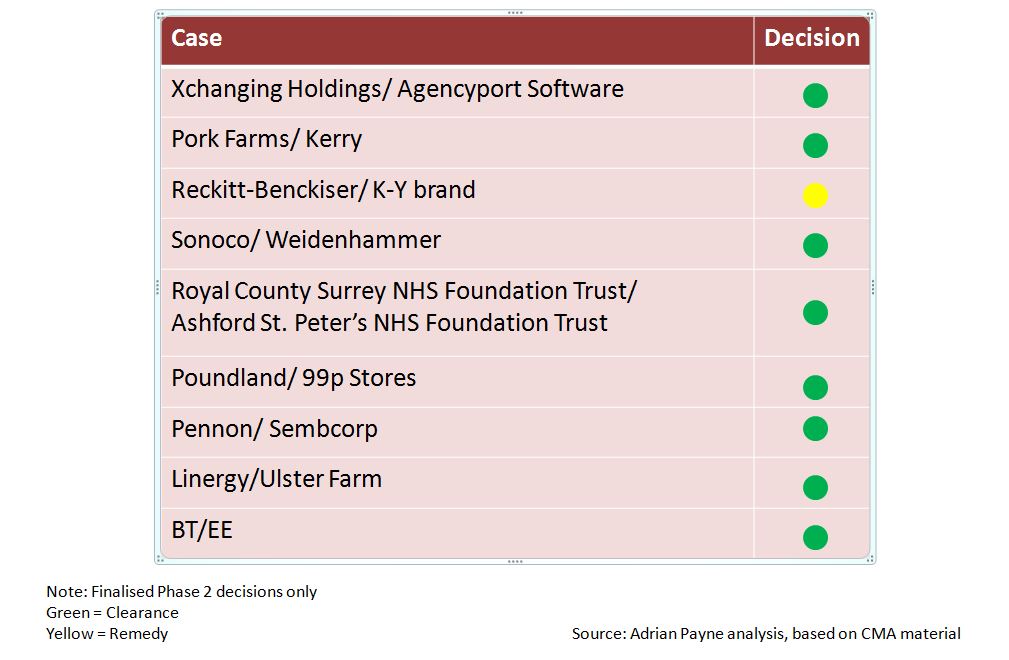

Looking at the 40+ past cases considered for de minimis (in public investigations) there could be good news for many merging parties if the future profile of cases resembles the past.

But much depends on how the CMA applies the ‘important’/’priority’ criteria in practice. For that reason self-assessment of merger control risk may become more difficult for a time – until sufficient case numbers allow us to see how the CMA applies these criteria that are currently rather vague.

There is another criterion too worth bearing in mind. This relates to mergers involving local markets. The CMA will continue to have regard to these in assessing whether to apply the ‘de minimis exception’, in case allowing a problematic deal through opens competition risks in other local markets. The good news for merging firms is that, on past form, only a handful of de minimis candidate cases have involved local markets.

Joy To The World

In the hopeful spirit of the season – and leaving these important uncertainties aside – further Christmas generosity to merging firms at hand.

The new arrangements contain none of the simple and cost-free measures that could have been proposed to restrict the scope for the more concerning deals (from a competition view) to go through unscathed – as well as clearing the way for future increases in the market size threshold.

In the words of the song, for merging firms

“It’s Beginning To Look Like Christmas”.